CREATE YOUR STARTER ACCOUNT

Your first 30 days are

Upgrade, downgrade or cancel anytime.

CREATE YOUR STARTER ACCOUNT

Your first 30 days are

Upgrade, downgrade or cancel anytime.

Earn a new revenue stream, provide more value to financial services clients, and get FREE leads by learning credit repair!

Credit repair is a great financial service business opportunity.

Think about it.

Online advertising can boost the number of leads...but will drain your budget.

Working harder at the same grind might yield slightly better results, and leave you exhausted.

As the competition multiplies, financial planners need to find opportunities to differentiate their businesses.

Offering credit repair gives you FREE leads for your other services without paying for financial services advertising and sets you apart from other financial services companies.

This credit repair business calculator will show you the potential of adding credit repair services. Scaling is made possible because software minimizes the work to a few minutes each month.

San Diego, CA

This all-in-one solution runs my entire business, pays for itself and is easy to scale. I've grown my business far beyond my wildest dreams!

Get Free Leads for Financial Services

Your credit repair clients become warm leads for your other financial services

Build client trust for more referrals

Those you help to repair their credit will trust your judgment and seek your help for other financial services and refer friends and family to you

Multiply Customer LTV

Credit repair is a unique tool to help clients at different milestones of their financial journey, which can increase their lifetime value as a client by 200 or 300%

79%

7.288 million

$5,700

44.3%

88%

Credit Repair Cloud can help differentiate your services from others in your industry. This business software allows you to offer your financial knowledge at a new milestone in your client’s financial journey, the credit repair phase. And, if you can successfully help your clients with credit repair, you can earn their long-term customer loyalty.

The role of a financial planner is to assist people through their financial situations. Clients ask you to and manage finances during life milestones like unexpected cash windfalls, planning for retirement, or other future investment options. Surprisingly, financial services providers don’t always provide assistance during the credit repair milestone, which is the phase that unlocks financial freedom and continued services from a financial planner. This gap creates a unique business opportunity for you to differentiate from your competition, add additional value to existing clients, and get free leads for your existing financial services business through credit repair!

The biggest hurdle for most financial services providers is getting clients to trust them with their financial lives. You already earned that trust as their current financial planner. Now you can use that relationship to help them further their financial goals and earn their referrals.

When you can educate your clients on better financial habits — from rebuilding credit to investing in their children’s education —you’re helping them improve their overall financial situation. And, happy clients equal more referrals to help their friends and family.

Acquiring new clients is difficult. As in most businesses, retaining client relationships is crucial to your business’s health and longevity. This is true whether you’ve been a financial planner for decades or just beginning to grow your clientele. Credit Repair Cloud is a great way to help add value to your clients and create a strong, lasting relationship. Credit Repair Cloud allows you to expand your financial service offerings by providing

Most of our software users find it takes them about five minutes of work per month per client after the first month, with many running very successful credit repair businesses that change thousands of lives.

Get the tools you need to help your existing tax preparation clients and learn how to convert them into loyal credit repair customers by reading our blog

and

Check out some of our free eBooks on how to run a successful credit repair business!

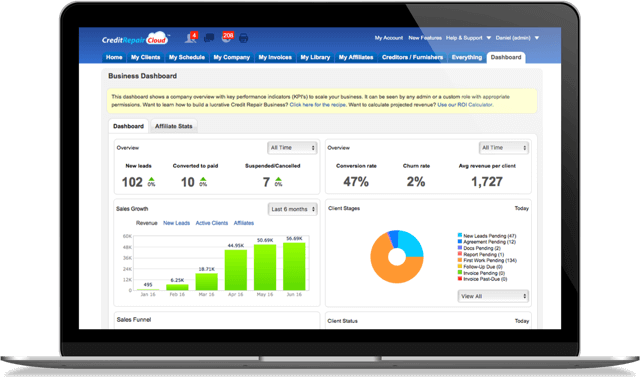

How Credit Repair Cloud

helps you run a profitable business.

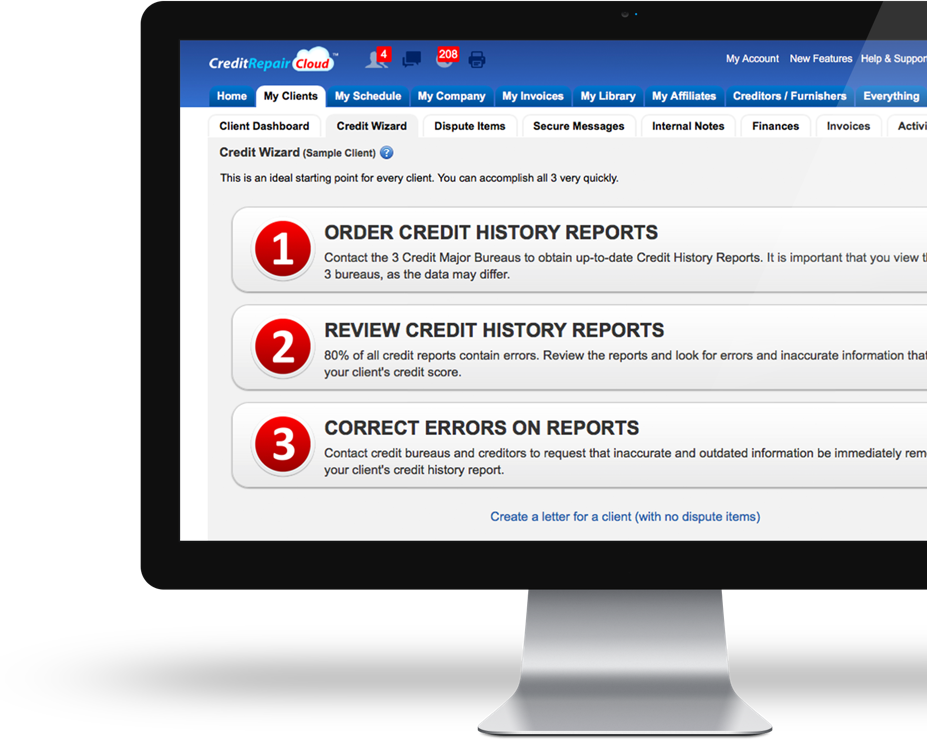

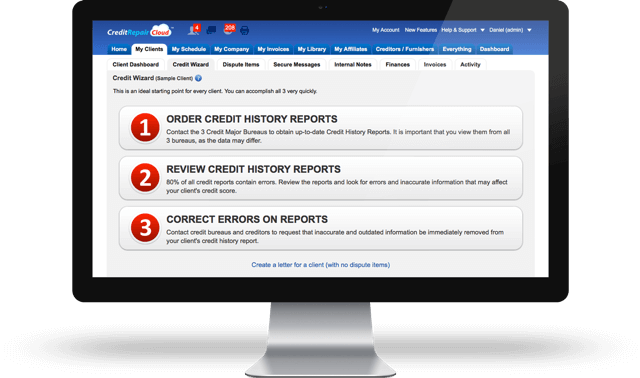

How our step-by-step ‘Dispute Process Blueprint’ saves you time and gives you the flexibility to run your business.

How our easy method gets you clients without paying for advertising.

Upgrade, downgrade or cancel anytime.

Run and grow your very own credit repair business.

CREDIT REPAIR CLOUD

12517 Venice Blvd.

Los Angeles, CA 90066

1-800-944-1838

Legal disclaimer: The information contained on this site and our guides are for educational and informational purposes only. It does not constitute legal advice, nor does it substitute for legal advice. Persons seeking legal advice should consult with legal counsel familiar with their particular situation as consumer credit laws vary by state.