You know you’ve found good friends when they provide support through the unknowns, help you carry your load, and make doing what you do more fun.

Your credit repair business software should offer the same level of dependability by being your business’s BFF. You deserve responsive support that’s available when you need it and helpful features that automate your work to make it easier, giving you more time to help more clients and focus on what you love doing.

The credit repair business software you choose matters. It can make, or break, your business success. Here are 7 features every credit repair software solution should offer you:

1. Integrations to Existing Business Software

If you already have clients from your main business (be it tax preparation, mortgage loans, or anything else) stored in Salesforce, you’ll want to keep your operations efficient with a credit repair business software that has APIs to support integrations to your chosen tools.

Your credit repair business software should have APIs for:

- Lead generation software

- Bookkeeping software

- CRM software

Be sure your software releases software updates that reflect industry trends and user needs.

2. Dispute Process Automation

One of the most valuable services you provide to clients is writing dispute letters and following up with creditors on their behalf. Since you will be handling hundreds of clients a month, you’ll want to have a system in place to automate the busy work for you.

Your credit repair software should make disputing negative items this easy:

- You can run a credit audit for clients in seconds with automation

- When you tag dispute items, your software automatically inserts them into dispute letters

- Calendar alerts remind you to follow up with clients (through your API integration)

- Affiliate referral fees are automatically processed by your software so affiliates keep sending more and more business your way

- Client follow up takes about five minutes per month

If your experience differs, you should ask yourself if you’re using the right software for your business. Keep reading for other signs you’re onto something good.

3. Thought Leadership in the Industry

Credit repair software is the platform for your credit repair business. It should support business growth by understanding and helping set industry best practices.

Is your credit repair software company an industry thought leader?

Credit repair business owners making millions in revenue need ongoing advice in the form of webinars, training expos, and online business education tools to keep their business growing.

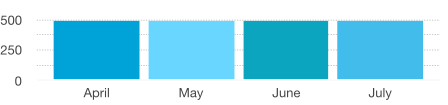

4. Pricing for Business Growth

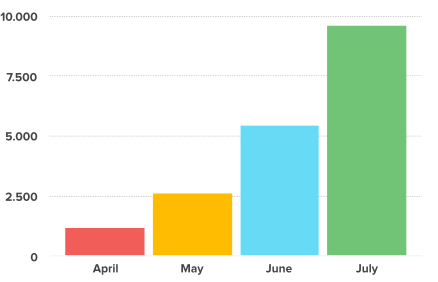

Don’t spend half of your first month’s income on your credit repair software. Invest in credit repair business software that has a scalable pricing model for your operational expansion. If you are paying too much up front, you may lose heart. You should only pay more as you increase the number of users--a positive sign that your credit repair business is growing along with your team!

Here are some credit repair software pricing rules of thumb:

- Spend no more than $60 for each team member so you can expand your team quickly to scale your business, without limiting caps on the number of users ensure unlimited storage, so you don’t have to choose between more disputed items or a higher price tag. Try it out for FREE: Make sure you get at least a 30-day trial for free to test if the software will work for you.

5. Referral Management Tools

A financial affiliate is a business whose leads or customers can benefit from credit repair. Often, by referring leads for credit repair services, the leads will and later become clients of the affiliate.

For example, if a mortgage broker cannot help a prospect qualify for a home loan because of a less-than-perfect credit score, he can refer that client to a credit repair company. After the credit score is repaired, the prospect can come back to the mortgage broker for a great loan.

Professionals in real estate, the auto industry, mortgage brokers, and more will happily refer clients to you if it means they will close the sale after your shared client is now approved for a loan or a better rate.

Ensure your credit repair software offers referral management tools.

When they send clients your way, we suggest you send them a thank you in the form of a referral fee. Some of the most successful credit repair businesses built their business 99 percent from affiliate referrals.

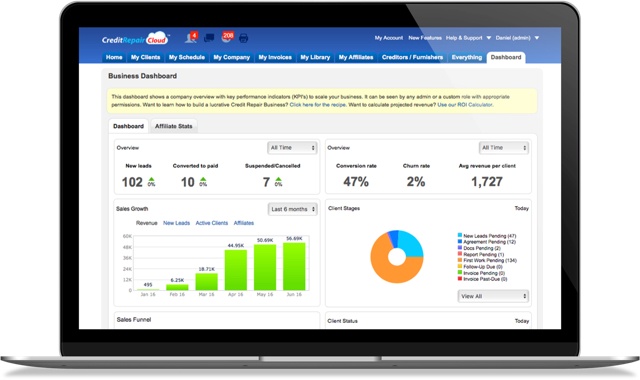

6. Creates Opportunities for Growth

You can run your credit repair business with only a computer, a phone, and credit repair software, but eventually, you’ll outgrow your home office.

Your credit repair business software should support scalable team growth with affordable user pricing, as well as credit repair education and an intuitive UI that makes training your team simple.

The most successful credit repair business owners are great at talking with people, and this industry often draws personable folks who genuinely enjoy chatting with their clients and helping out their community. The last thing you want to do is get stuck processing paperwork in the office all day or playing tech support for your business software.

Your credit repair business software must automate the dispute process and help your team function seamlessly when you’re in the office or out talking with people in your community one-on-one.

7. A Fan Base

When you make an investment in business software, you want to know it’s been tried and tested and other credit repair business owners have found success with it. These days social proof is a critical ingredient to modern business success and almost every website has a testimonials section. Be sure to read through the testimonials and the success stories that software companies have on their website.

Some credit repair software companies have users who are beyond excited to tell you about how their software helps them run a successful credit repair business.