CREATE YOUR STARTER ACCOUNT

Your first 30 days are

Upgrade, downgrade or cancel anytime.

CREATE YOUR STARTER ACCOUNT

Your first 30 days are

Upgrade, downgrade or cancel anytime.

January to April Hustle: Your Tax Preparer salary has some high highs and low lows throughout the year. In the beginning of the year, you scramble to complete forms and use your tax preparer training and business savvy to help clients save money.

May to December Availability: For the remaining eight months, you’ve still got bills to pay, and a pretty amazing skill set when it comes to understanding financial math and how to help people keep more of their income for themselves.

The Ultimate Solution: Becoming a credit repair specialist helps you fill the inevitable eight-month income gap and use your financial sense and business mindset to help clients further improve their financial well-being.

This credit repair business calculator will show you the potential of adding credit repair services. Scaling is made possible because software minimizes the work to a few minutes each month.

San Diego, CA

This all-in-one solution runs my entire business, pays for itself and is easy to scale. I've grown my business far beyond my wildest dreams!

Laredo, TX

We have a tax preparation business. My partner and I decided to branch out into credit repair. Credit Repair Cloud now helps us to build our customer base for the tax business. It is a wonderful tool for lead generation. Credit Repair Cloud provides superior customer service. You have gained a customer for life!

Ensure year-round income

Offering credit repair is complementary to your tax preparation business

Generate leads interested in financial advice

Those you help to repair their credit will trust your judgment and seek your help for other financial services

Increase the value of existing clients

By offering credit restoration services to your tax preparation clients, you increase the value of each customer to your business

79%

$5,700

44.3%

88%

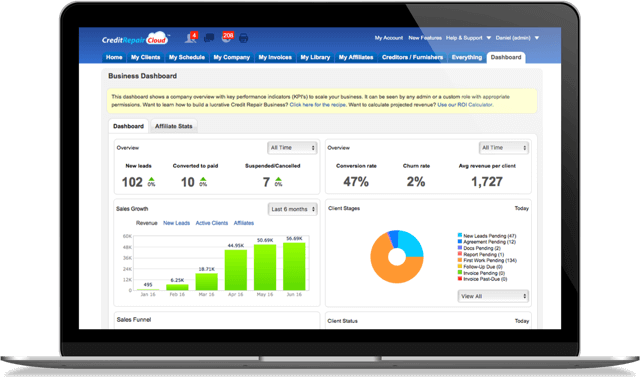

Credit Repair Cloud is a business software designed to help entrepreneurs like you run and grow a profitable credit repair business. Keep your clients engaged throughout the year and depend on a regular, additional income stream in your tax preparation business’ lean months.

Whether you’ve been in the tax industry for decades or just finishing your first tax season, Credit Repair Cloud can help you maintain a steady stream of income year-round. Create extra income by offering clients credit counseling and credit repair services.

The biggest hurdle for most financial services industries is getting clients to trust them with their financial lives. You already earned that trust as their tax preparation expert. Now you can use that to help them further their financial goals and generate leads who want your financial advice. When you can educate your tax preparation clients on better financial habits throughout the year and help them improve their overall financial situation with credit repair services, clients will send more friends and family to you!

Use Credit Repair Cloud to seamlessly integrate tax preparation clients into your credit repair business. Your income stream can increase tenfold with your existing clients.

Most of our software users find it takes them about five minutes of work per month per client after the first month, with many running credit repair businesses with a high six-figure revenue for years now.

Get the tools you need to help your existing tax preparation clients and learn how to convert them into loyal credit repair customers by reading our blog

and

Check out some of our free eBooks on how to run a successful credit repair business!

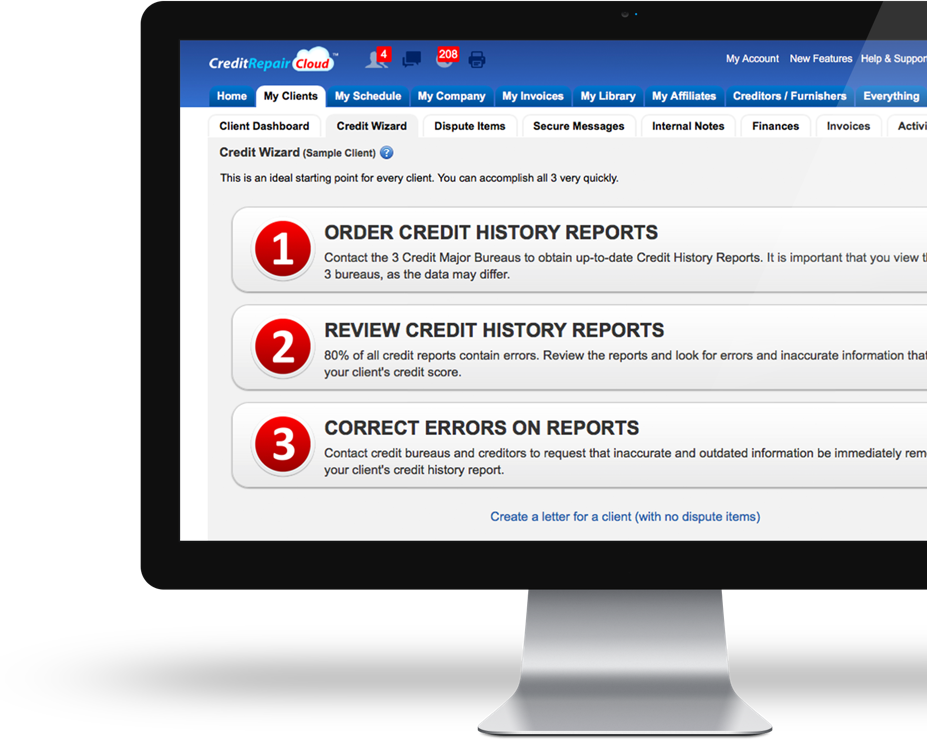

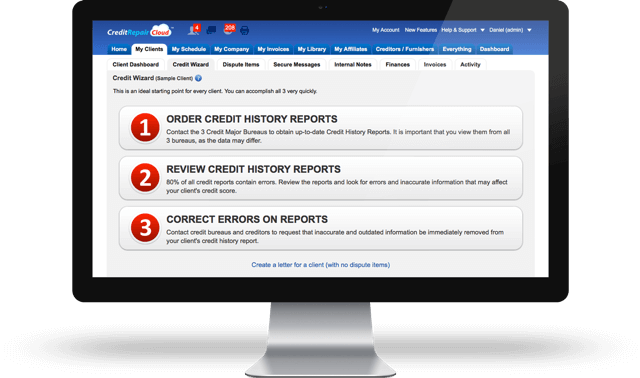

How Credit Repair Cloud

helps you run a profitable business.

How our step-by-step ‘Dispute Process Blueprint’ saves you time and gives you the flexibility to run your business.

How our easy method gets you clients without paying for advertising.

Upgrade, downgrade or cancel anytime.

Run and grow your very own credit repair business.

CREDIT REPAIR CLOUD

12517 Venice Blvd.

Los Angeles, CA 90066

1-800-944-1838

Legal disclaimer: The information contained on this site and our guides are for educational and informational purposes only. It does not constitute legal advice, nor does it substitute for legal advice. Persons seeking legal advice should consult with legal counsel familiar with their particular situation as consumer credit laws vary by state.