Credit repair is always changing. There's new tactics, new letters, and new policies put into place.

But some things never change. The credit bureaus always want to discourage you from repairing your credit because that costs them money.

But you HAVE to be persistent to really change lives.

That’s why I’m sharing these expert strategies to combat stall letters so you can get results faster!

OK, LET'S GET INTO THIS…

Over the years, I’ve seen a ton of changes to credit repair, including the introduction of credit repair software like Credit Repair Cloud! 20 years ago there wasn’t anything to help me when I started to fix my credit after a bank error ruined it! That’s ultimately why I started Credit Repair Cloud.

New laws and regulations have been introduced. There’s been changes to disputing tactics, some legit and some that are just created to sell you something…

But what’s always stayed the same is that the Credit Bureaus don’t want you to succeed! It costs them money to investigate each dispute, so they just want to discourage you so you’ll go away.

So, while I’ve been seeing more and more questions from credit heroes about stall letters, the bureaus' wanting to slow you down isn’t new!

HERE'S HOW THIS RELATES TO US…

There are three most common types of Stall Letters:

Suspicious Request

Frivolous Request

Insufficient Identification

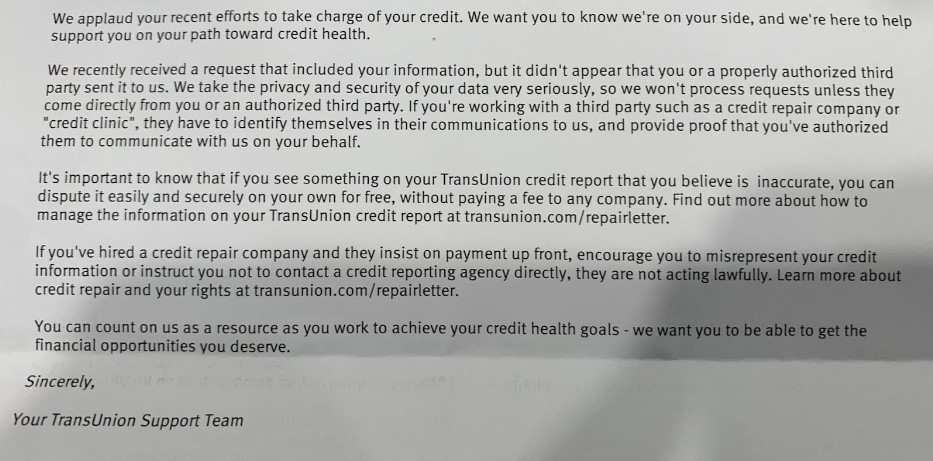

A Suspicious Request seems to be the most common Stall Letter. TransUnion sends this one the most. In it, they say they received a request that included your information, but it didn’t appear that you or a properly authorized third party sent it to us. Bla bla bla… basically they didn't think it was from you.

Insufficient Identification is pretty self-explanatory, but it usually means that you didn’t include photo ID and proof of address.

Insufficient Identification is pretty self-explanatory, but it usually means that you didn’t include photo ID and proof of address.

A Frivolous Request usually happens when you attempt to dispute too many items (or every single item) all at once.

When you get these, don’t be discouraged. Because that’s why they send these!

Don’t fall for it. Just keep pushing.

The truth is, there isn’t a guaranteed way to avoid these stall letters. But there’s lots of things you can do to prepare for them and ways to fight back!

HERE'S THE THING TO REMEMBER…

Success in credit repair is built on patience and persistence. Try to embrace the challenges. They mean you’re on the right path and are stepping stones to success.

But you also have to prepare for those challenges. Knowing that you’re probably going to get stall letters and having a plan to tackle them is huge. And almost more important is honest communication with your clients.

The stall letters that come in the mail look really nasty and can freak you out if you’re not expecting it. Let your clients know upfront that getting a stall letter is a big possibility, let them know what it might say, and let them know that it's all part of the whole game plan.

HERE'S WHY THIS IS IMPORTANT…

You can’t forget that the credit bureaus primarily serve the big banks, not the consumers.

They use confusing tactics in the hopes that you’ll just give up. But we can’t just give up! The system won’t change unless we fight back.

But with a little bit of knowledge and determination, you can help your clients succeed and grow your business.

HERE'S WHAT YOU NEED TO KNOW…

Use these steps to fight back against stall letters and help your clients reach their goals.

1 - Keep Applying Pressure.

The most important thing to do when you first get a stall letter is NOT to panic! Don’t get discouraged or intimidated, that’s what the Bureaus want. Instead, stay laser-focused and turn up the heat.

2 - Be Ready to Adapt.

Like I said earlier, credit repair is always changing, and so are the tactics that work. Be prepared to try different strategies and learn from each experience. Make sure you continue to study the laws and learn from others in the industry.

Recently, super successful Credit Hero Michael Franks shared that he’s had huge success adding to his round one letters clear language, letting the Bureaus know that if they send an automated computer-generated letter he will sue them. And he says that has reduced his stall letters considerably…

And then, if his client does receive a stall letter, Michael has them file a CFPB complaint and go to their local courthouse and file a small claim against them.

This may not work for everyone but it’s important for you to consider all your options.

3 - Use New Tools.

As the needs of credit repair businesses change, Credit Repair Cloud is here to help. With more and more stall letters being sent in response to template letters, we’ve added an AI Letter generator to the software!

Because each letter is unique, the risk of the credit bureaus flagging your disputes as templates is reduced. Cool, right? In the fight against unfair stall letters, you gotta use all the resources you can!

HERE'S MY FINAL POINT…

Stall letters are a frustrating part of credit repair, but they aren’t new, and you can’t let them slow you down! Stay calm, communicate with your clients, be persistent, and fight back.

I'LL END BY SAYING

If you still need a Credit Repair Cloud account, check it out. It's the software that most Credit Repair businesses in America run on. Sign up here for a Free Trial!

And if you'd like to change lives and grow your Credit Repair business, check out our Credit Hero Challenge!

07f1.png)

It's an amazing program, and we've got another challenge starting in a few days, so grab your spot right now at CreditHeroChallenge.com!

So take care, Credit Hero!

And Keep Changing Lives!

Be sure to subscribe on your favorite platform below!

|

-1083c.png) |

-1dd56.png) |

-13371.png) |